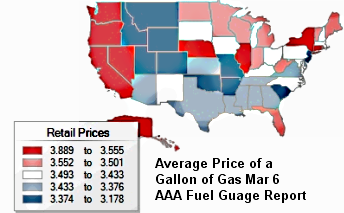

The average price for a gallon of gas rose 30 percent from $2.69 in July 2010 to $3.49 as of March 6. Most of that 30 percent has come in just the last few days.

The average price for a gallon of gas rose 30 percent from $2.69 in July 2010 to $3.49 as of March 6. Most of that 30 percent has come in just the last few days.

We’re about to embark on another period of let the markets take care of it. The Money Party manipulators are again jerking citizens around in the old bottom-up wealth redistribution program. Their imagineers are writing the storyline right now.

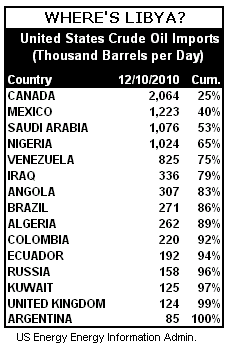

The conflict in Libya is causing the spike in oil prices over the past 10 days or so, according to the media script. Take a look at the chart to the right. Can you find Libya among the top 15 nations supplying the United States with crude oil?

Why the current panic over gas prices?

The general explanation points to the crisis in Libya as the proximate cause. The anti Gaddafi regime revolution began in earnest on February 17. But if the Libyan revolution were the cause, we’d have to attribute a 50 percent drop in a 2 percent share of the world’s oil supply as the cause of the panic. We would also have to attribute the increase in US gas prices to a nation that doesn’t impact the US crude oil supply and, as a result, should not impact the price of gas here.

The speculators have an answer. The Libyan situation entails fears of broader unrest in oil and non-oil producing nations in North Africa and the Middle East. There is unrest, without any doubt. Citizens are insisting that their kleptocratic rulers cease and desist from looting their nation’s treasuries and resources. The demonstrations across the region, revolution in Egypt, and war in Libya are all being fought under the banner of broader participation in government, greater access to essentials like food, jobs, and hope for future improvements. Notably lacking is anti-US rhetoric or religious fanaticism.

Somehow, the opportunity for secular, democratic regimes equals a crisis for US energy prices. The embedded assumption is that the conflicts leading to new regimes will cause a disruption in the flow of oil. With the exception of Libya, none of these countries have reduced their oil production, including oil-producing Egypt. In fact, Saudi Arabia and the United Arab Emirates increased oil production to compensate for the short fall due to the military conflict in Libya.

Somehow, the opportunity for secular, democratic regimes equals a crisis for US energy prices. The embedded assumption is that the conflicts leading to new regimes will cause a disruption in the flow of oil. With the exception of Libya, none of these countries have reduced their oil production, including oil-producing Egypt. In fact, Saudi Arabia and the United Arab Emirates increased oil production to compensate for the short fall due to the military conflict in Libya.

If we don’t believe that Libya is the cause, then we get the excuse of emerging democracies. If emerging democracies fail to catch on as the scapegoat, there will be other excuses.

The Money Party bottom line is apparent. It’s time to take some more money from citizens. Any plausible reason will do. When you own the media, you have no worries. Who’s going to bust you?

The big payday at your expense

The gas price shock and awe is not evenly distributed. The Western states, New York, Illinois, and Nebraska are taking the biggest hits. There’s some explanation for this but not a very good one. All that matters is taking as much in extra profits as possible while the extraordinary events in Libya and the rest of the region allow a plausible storyline. This time, democracy is the villain.

These gas prices will have a direct impact on those least able to afford it. It will cost more to go to work or look for jobs. Commodities will go up even more than they are now. Transportation for the distribution of all products will have an impact on prices. Tourism will fall off. The feeble increases in hiring may be at risk and there will be more gloomy news about how this all impacts the prospects for any sort of economic recovery.

What’s really driving gas prices?

In a recent Business Insider column, David Moenning noted:

“At least part of the reason behind crude’s rude rise is the price action itself. Hedge funds and other fast-money types have begun to pile into what appears to be a burgeoning uptrend in the oil charts (take a peek at a weekly chart of USO and you’ll see what we mean). Then when you couple the price action with the news backdrop, this appears to be the new place to be for the ‘hot money.’” David Moenning, Business Insider Mar 6

We have the usual suspects looking for hot money. The fast-money types, as Moenning calls them, smell another victory in the air. Their market activity is driving prices in a self-reinforcing cycle of increases that are highly profitable when you get in and out at the right time (and if you pull the strings for the market, that’s easy).

We have the usual suspects looking for hot money. The fast-money types, as Moenning calls them, smell another victory in the air. Their market activity is driving prices in a self-reinforcing cycle of increases that are highly profitable when you get in and out at the right time (and if you pull the strings for the market, that’s easy).

Who is looking out for our interests?

No one. Have you heard of any congressional investigation? The oversight committees for the Departments of Energy and Commerce are two likely starting points. Nothing. President Obama is threatening to tap the US strategic oil reserve to use market forces to push crude oil and gas prices down. Fed Chairman Ben Bernanke sees commodity price increases, including crude oil, as a temporary phenomenon. They may create a problem, however.

“Rises in the prices of oil or other commodities would represent a threat both to economic growth and to overall price stability, particularly if they were to cause inflation expectations to become less well anchored,” Bernanke said before Congress last week. Ben Bernanke, March 1

Doing nothing, like Congress, and trying to manipulate market forces, as the president says he might, are not the heavy-hitters needed to stop this latest rip off. They both buy into the belief that there is some sort of occult mystery to why prices are going up. Everyone who benefits will raise prices because they can. They have no concept of enough and there is nobody standing in their way.

What would JFK do?

There was a time when the president of the United States stood up to big business. President John F. Kennedy put his prestige and word on the line when he helped the steel industry and labor unions negotiate a contract that the president thought was fair to all, a deal he hailed as “non-inflationary.” Just days after the settlement, US Steel turned around and issued a major price increase. This would have hurt the economy due to the central role of steel at the time.

Kennedy felt betrayed by US Steel and the others that raised prices. He wasted no time in his response. The Department of Defense said it would buy steel from the lowest bidder. This would have excluded US Steel and their fellow price gougers. The Justice Department began investigations and issued antitrust indictments of the big steel producers. Kennedy also went to the public to gain support for his efforts.

Big steel backed down. The broader business community complained. The Kennedy administration and others reminded everyone that the government acts in the public interest when business threatens the interests of the people. What a novel concept.

This article may be reproduced entirely or in part with attribution of authorship and a link to this article.

Michael Collins is a writer in the DC area who researches and comments on the corruptions of the new millennium. His articles focus on the financial manipulations of The Money Party, the abuse of power by government, and features on elections and election fraud. His articles can be found here. His website is called The Money Party.